Life insurance has been the traditional go-to for individuals seeking financial security for their loved ones. While it undeniably serves a crucial purpose, there’s an alternative that offers a more direct and practical solution—funeral pre-planning. We’ll explore the logistical advantages of funeral pre-planning and how it can stand out as a comprehensive alternative to conventional life insurance policies.

When it comes to the logistics of handling a loved one’s passing, funeral pre-planning simplifies the process. By documenting your preferences in advance, you eliminate the need for your family to navigate complex decisions during an emotionally charged period. From choosing the type of service to deciding on burial or cremation, your pre-planned arrangements guide your family through these choices, minimizing stress and potential disagreements.

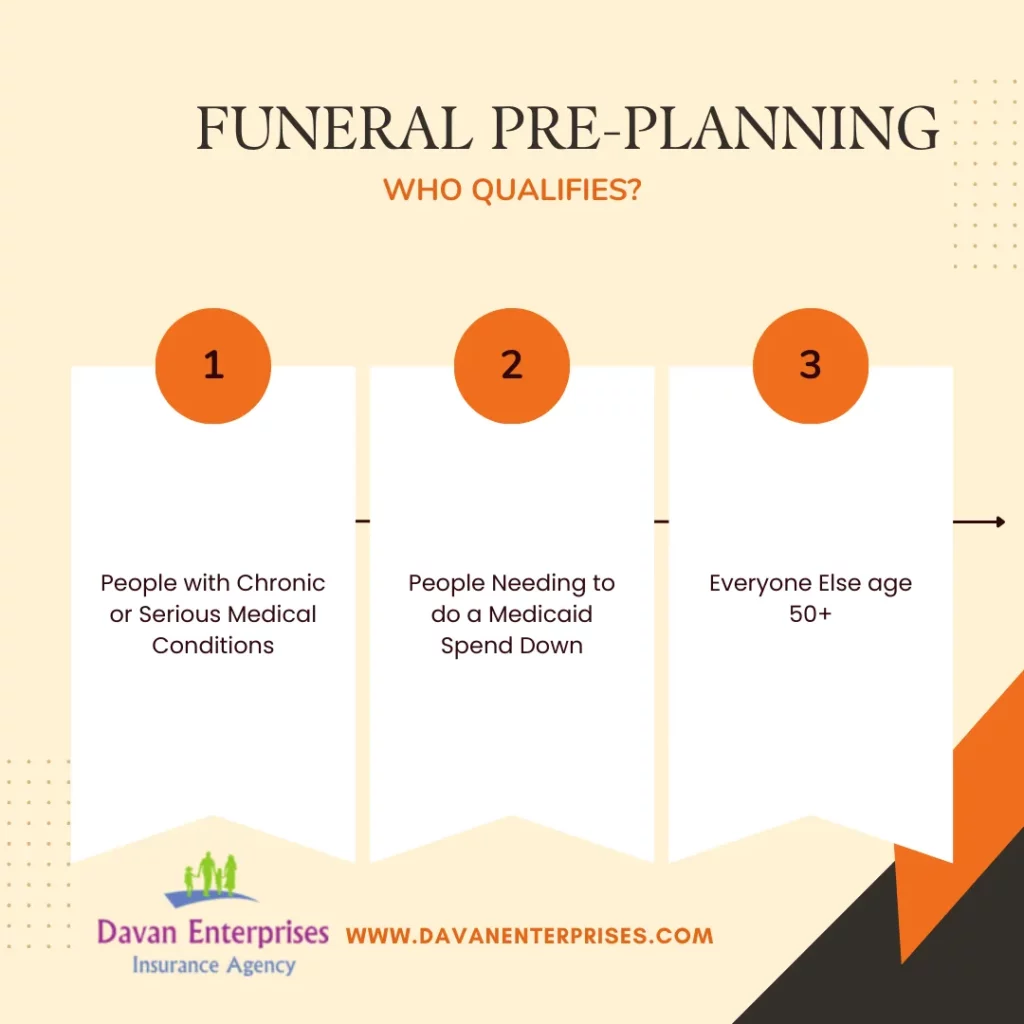

Moreover, funeral pre-planning addresses the financial aspect with a level of specificity that life insurance may lack. While life insurance provides a lump sum, funeral pre-planning allows you to allocate funds directly to funeral expenses. This targeted approach ensures that the financial support you leave behind is dedicated to covering the costs associated with your final arrangements while also providing a shelter for assets in circumstances where state Medicaid programs are involved.

In essence, funeral pre-planning stands out as a practical choice that streamlines the logistical challenges your loved ones may face. It not only simplifies decision-making but also offers a clear and direct solution to the financial aspects of your passing, making it a comprehensive alternative to traditional life insurance policies. To learn more or start your funeral planning today schedule an appointment with our agents at Davan Enterprises Insurance Agency.